Our Q4 2023 trends and insights highlight the dynamic landscape of the financial industry, and the strategies organisations are adopting to navigate it.

Exciting Financial Trends:

Key Q4 Talent Market Dynamics:

Insights by Area of Specialism

Infrastructure

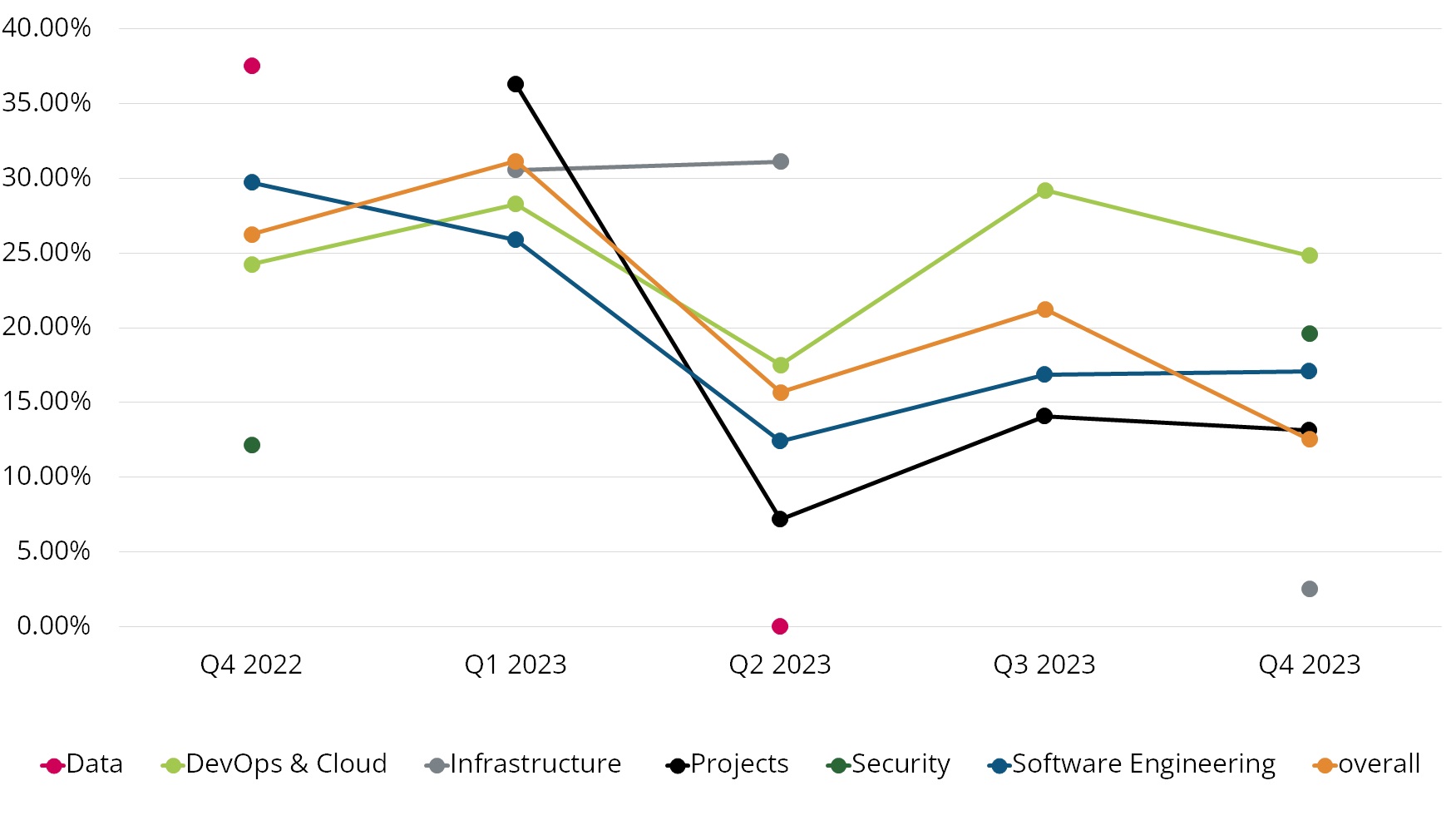

Infrastructure has historically been the lowest in Q4, and unsurprisingly came back into picture at a mere 2.5%. Following the trend we expect this to recover in Q1.

Software Engineering

There was a slight increase in the rate of salary increments, rising from 16.86% in Q3 to 17.07% in Q4.

DevOps & Cloud

There was a slight dip in salary increments, decreasing from 29.20% in Q3 to

24.85% in Q4.

Projects & Change

Similar to Devops & Cloud, there was a slight dip in salary increments, dropping

from 14.10% in Q3 to 13.14% in Q4.

Cyber Security

Demand for Cyber security professionals held steady and was our second highest performing skillset at 19.63%

Overall

The weakening of increments across multiple skillsets saw average increments drop to 12.54% in Q4, almost half of 21.24% that we saw in Q3.

Average Increments

With a proud culture of delivering deep industry-aligned expertise, we’re your partner in shaping the careers and teams of tomorrow and beyond. Talk to us today. Or signup below for future insights straight to your inbox.