Singapore continues to be a dynamic and exciting hub for talent where the demand for skilled professionals is shaped by a myriad of factors. From Singapore's rise as a hub for expatriates and corporate talent, to the strategic shifts in multinational corporations investing in advanced technologies, the landscape is constantly evolving.

Companies are now exploring offshore centers and contingent staffing to navigate headcount limitations, while also focusing on retaining top talent through compelling incentives. As we explore Q1 2024, the trends indicate a resurgence in demand for technology experts in the financial services industry. Explore our latest quarterly analysis to understand what drives demand and how to stay ahead in this competitive market.

What is driving demand?

Anticipated Drivers of the Q1 Talent Market

Insights by Area of Specialism

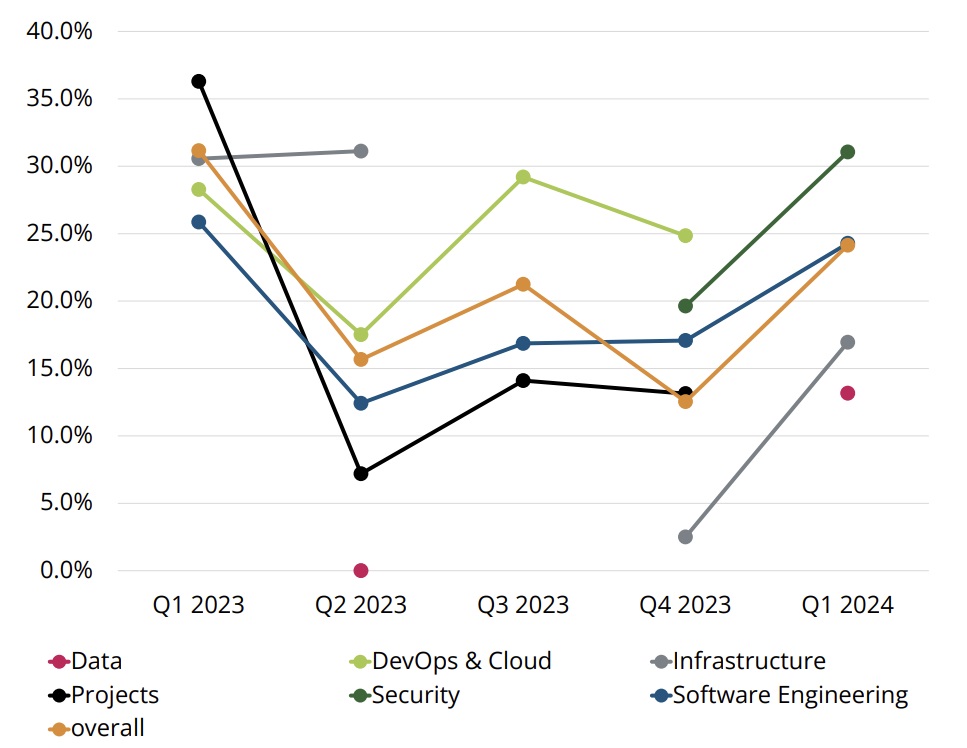

Infrastructure

As expected Infrastructure hiring bounced back in Q1 to an average of 16.94%.

Software Engineering

There is an upwards trend for Software Engineering increments. We saw average increments increase from 17.07% in Q4 to 24.28% in Q1.

Data

Data came back into the picture with a modest 13.16%.

Cyber Security

Cyber security was the top performer in Q1 and saw average increments at 31.06%. We are seeing steady demand for this skillset with clients creating headcounts in this space.

Overall

With both Cyber Security and Software Engineering increments coming in above 20%, we saw an average of 24.14% across the market, which is a good start for 2024.

Average Increments

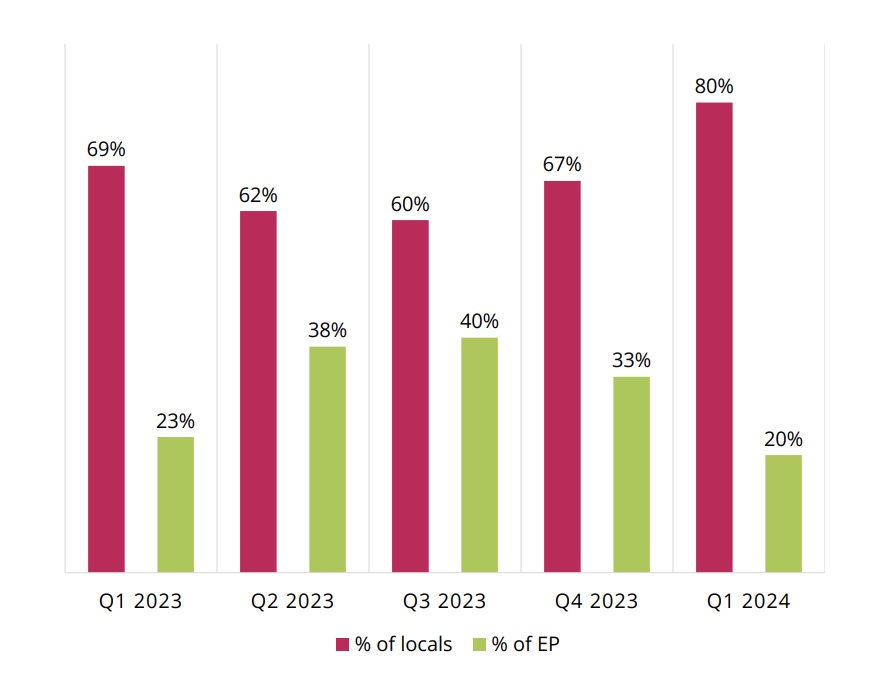

Placements

Local Talent

With a proud culture of delivering deep industry-aligned expertise, we’re your partner in shaping the careers and teams of tomorrow and beyond. Talk to us today. Or signup below for future insights straight to your inbox.