Explore our latest quarterly insights report to learn more about the ever-evolving dynamics of the recruitment landscapes in Singapore and Southeast Asia. This report leverages our real-time Salary Index data, alongside an in-depth analysis of actual placements since 2020, to provide you with actionable insights that you can use to stay ahead of the curve.

Our report covers:

- Market pulse. We explore the key trends driving demand across various industries in Singapore while highlighting the growing cost-efficiency considerations leading companies to explore Southeast Asian talent pools.

- Demand drivers: Gain a deeper understanding of the factors currently shaping the market, including the rise of contingent workers, increased focus on data centre capabilities, and the resurgence of the blockchain market.

- Looking ahead: We anticipate the impact of global events, the evolving hiring process, and the return of pre-pandemic salary increments. Our report also explores the continued importance of COMpass compliance and the strategic use of offshore resources.

What is driving demand?

Anticipated Drivers of the Q3 Talent Market

Insights by Area of Specialism

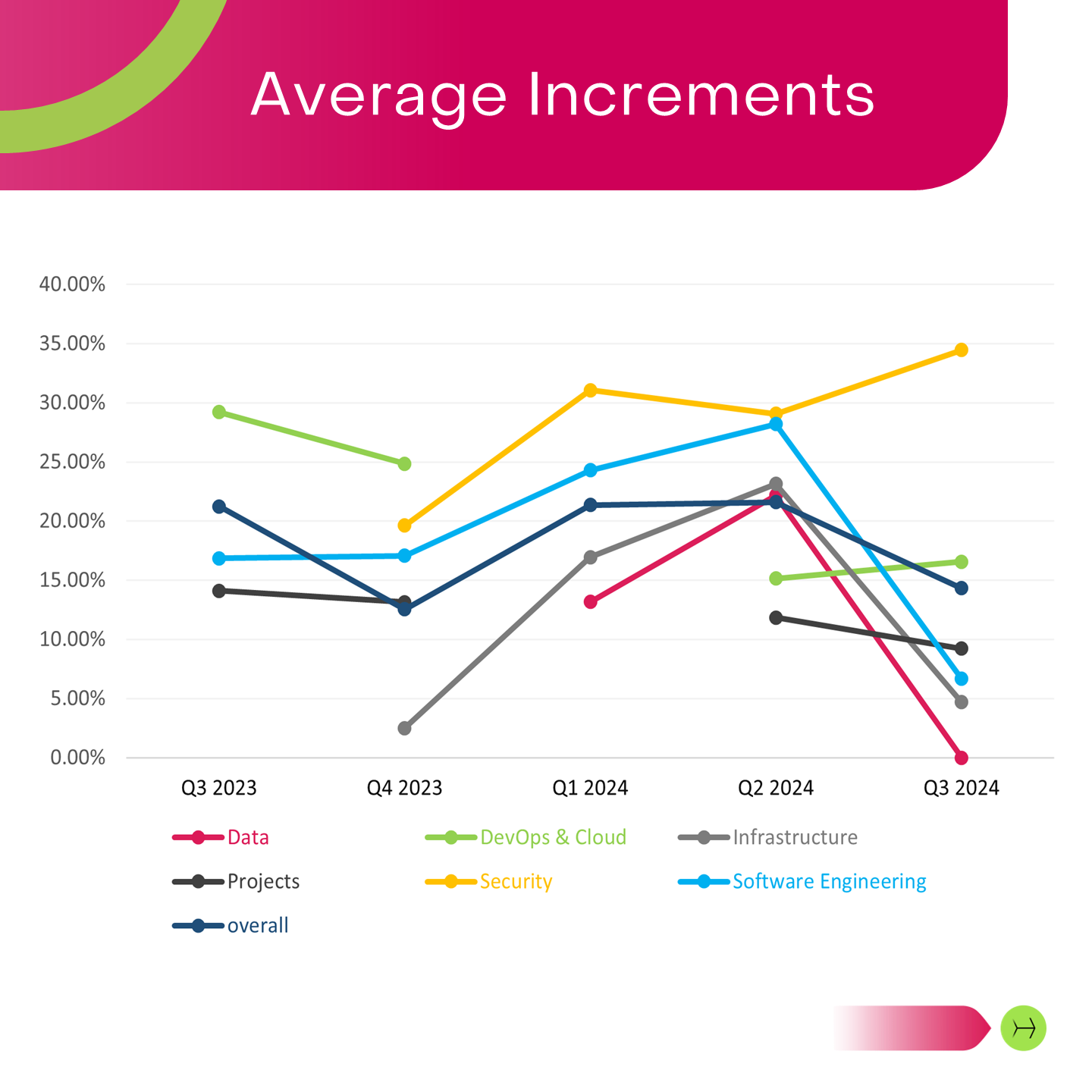

Infrastructure

Q3 for Infrastructure hiring drops from an average of 23.15% to an average increment of 4.7%.

Software Engineering

There was a significant drop for Software Engineering, with average increase at 6.67%. This is the lowest in the last 4 quarters.

Cyber Security

Last quarter's top performer, maintained it's position with average increments steady at 34.36%.

Cloud & Dev Ops

The average increments held steady for this skillset at 16.56%.

Projects

There was a slight drop for Project hires to land at 9.22% vs 11.84% the last quarter.

Overall

We saw an average growth of 14.32% across the market.

With a proud culture of delivering deep industry-aligned expertise, we’re your partner in shaping the careers and teams of tomorrow and beyond. Talk to us today. Or signup below for future insights straight to your inbox.